Connor Read (co-founder of the Shutl e-bike rental service) has alerted me to an interesting but troubling development in the world of fringe-benefit tax (FBT). Many of you may know that current legislation in NZ requires FBT to be paid against many “perks” provided to staff by employers but intriguingly gives an exemption for staff provided with a work motor vehicle. No similar exemption is currently available if the employer wishes to provide staff with a bike or public transport support for their journey to work – instead you’d have to pay FBT of 64% on top of the value paid. It’s no wonder then that New Zealand has one of the highest car ownership rates in the world, while nationwide very few journeys are completed by walking, bicycles or public transport.

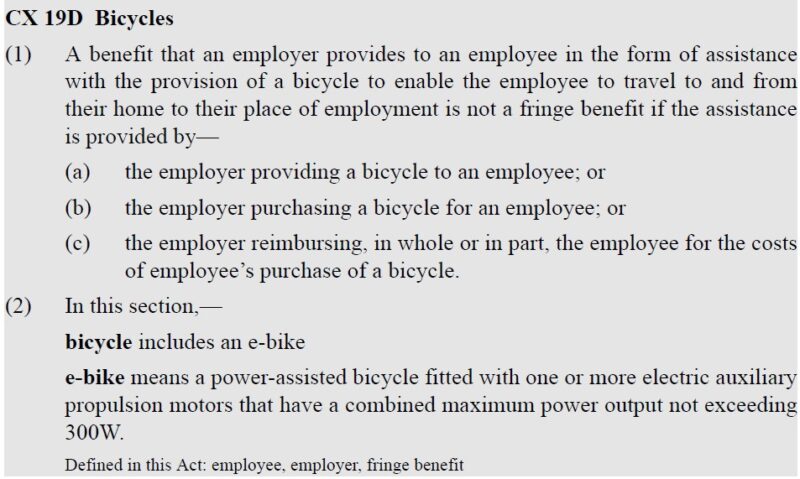

Last year Green MP Julie Anne Genter introduced the ‘Clean Transport FBT Exclusions’ Bill into parliament to add FBT exclusions aiming to incentivise the adoption of active and clean methods of commuting. This included new sections of the relevant legislation that also introduced FBT exemptions for public transport passes paid for by the employer (clause CX 19C) and the purchase/provision of a bicycle (including e-bikes) by the employer (clause CX 19D).

Some elements of this Bill got incorporated into the current reading of the Taxation Bill. But, while the public transport components were retained, the proposed new sections for bike FBT exemptions have been omitted… Omitting this FBT exemption denies the ability of New Zealand employers to implement a bike-to-work scheme. This is in contradiction to the initiatives outlined in our national emissions reduction plan, which promotes incentives for the adoption of bikes and e-bikes in our urban centres – we require a significant mode shift from cars to bikes to achieve our emission targets.

This Bill is currently open for submissions, so if you would like to raise your objection to the omission of this aspect of the Bill, make a submission here – you’ve got until Nov 2nd. Ask the Select Committee to “implement section CX19D from the Clean Transport FBT Exclusions Bill to help achieve the targets outlined in the emissions reduction plan”.

What do you think of the oversight of bike purchase FBT exemptions?

Already submitted.

It’s a no-brainer!

Yes -> I totally support adding bikes (and e-bikes) to the FBT exemptions.

I also think all combustion motor vehicles should be removed from the FBT exemptions !!!

It’s 2022 and we are in a Climate Emergency.

We must reduce carbon emissions in all areas of our society, especially transport.